When a fighter moves up to a heavier weight class, it’s always a risk. Some adapt quickly and find success, while others struggle against bigger opponents. So, is it actually worth the risk to change weight-jump?

To find out, we analyzed data from all UFC fights between 2015 and 2025 where a fighter moved up in weight. We then honed in on three potentially influential factors: height, reach, and the weight class the fighter moved into. For our analyses, we measured win rate as well as betting return on investment percentage (ROI%). While win rate does give a decent overview of how moving-up fighters performed, it also can be skewed by mismatches in fighter quality. ROI%, on the other hand, directly reflects how fighters performed compared to the market’s expectations, making it a more reliable indicator of whether Weight-Jumpers overperformed or underperformed.

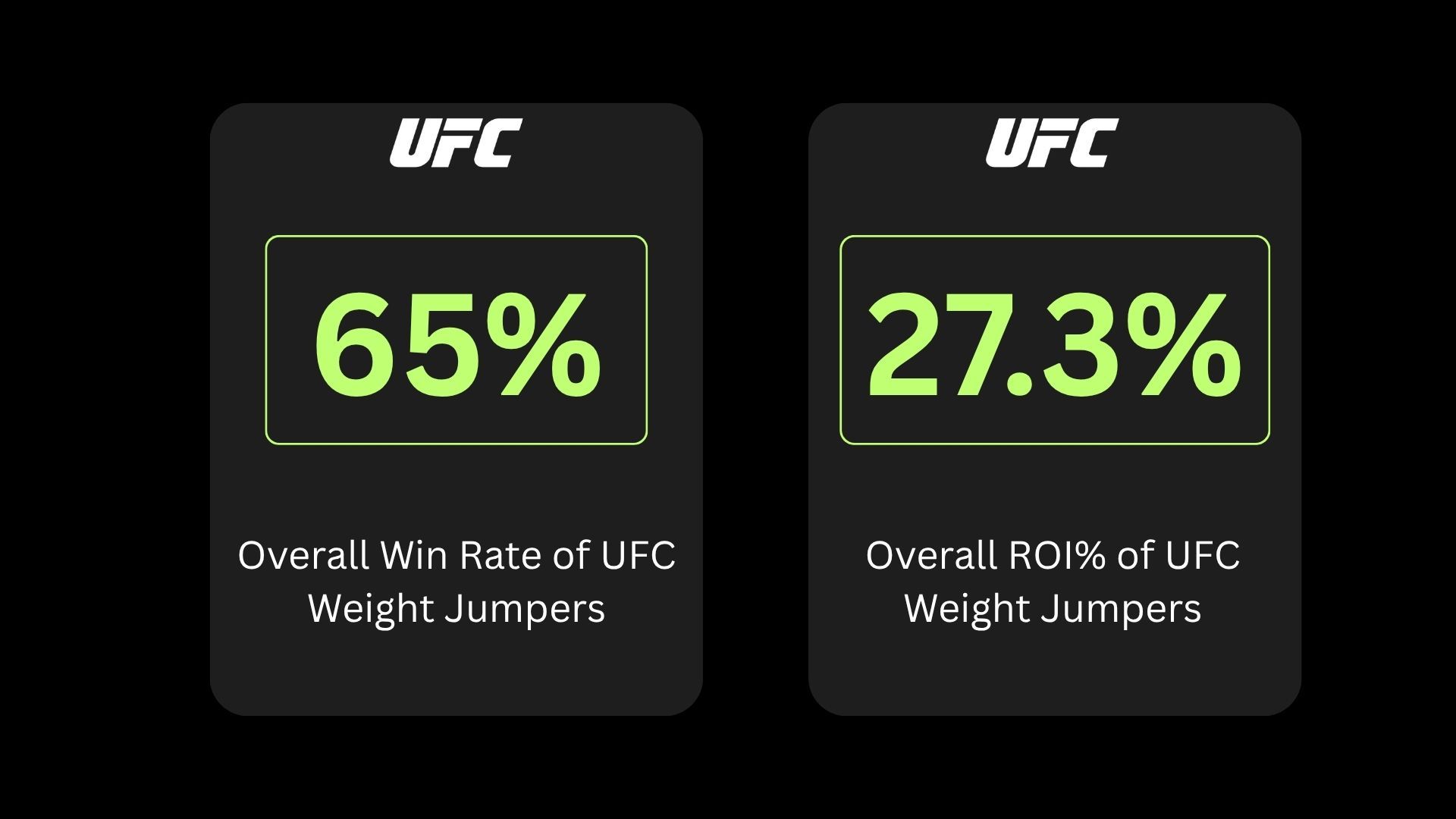

Overall Results

Across all UFC fights from 2015 to 2025 where a fighter moved up in weight, Weight-Jumpers held a win rate of 65% and returned an ROI% of 27.3%.

These results show that, as a group, fighters moving up in weight have both secured wins at a solid rate and delivered positive returns for bettors, meaning they collectively outperformed market expectations. However, this overall picture doesn’t reveal whether certain traits, such as height, reach, or the specific weight class moved into, are linked to that success. To answer that, we broke the data down further.

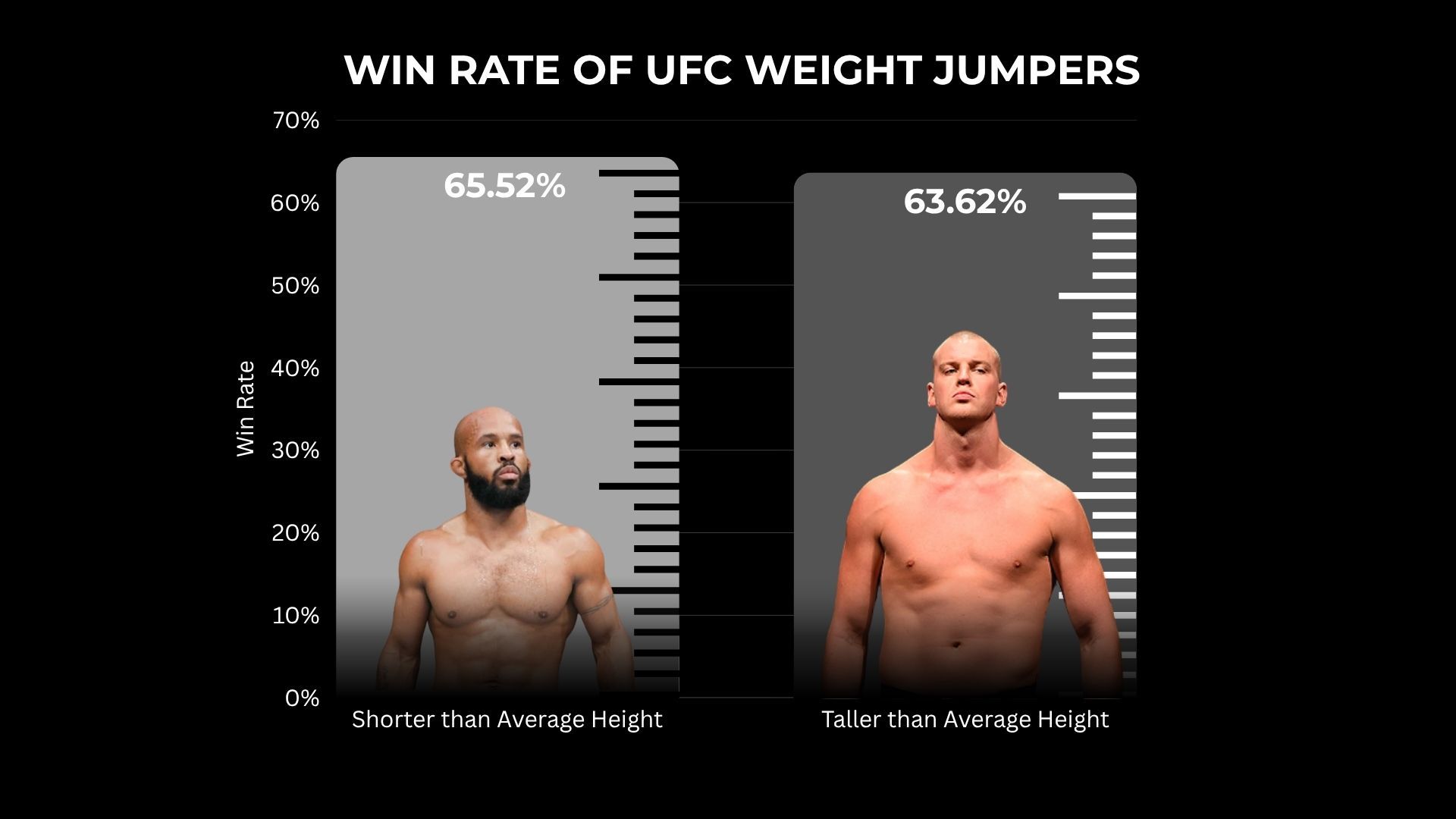

Height

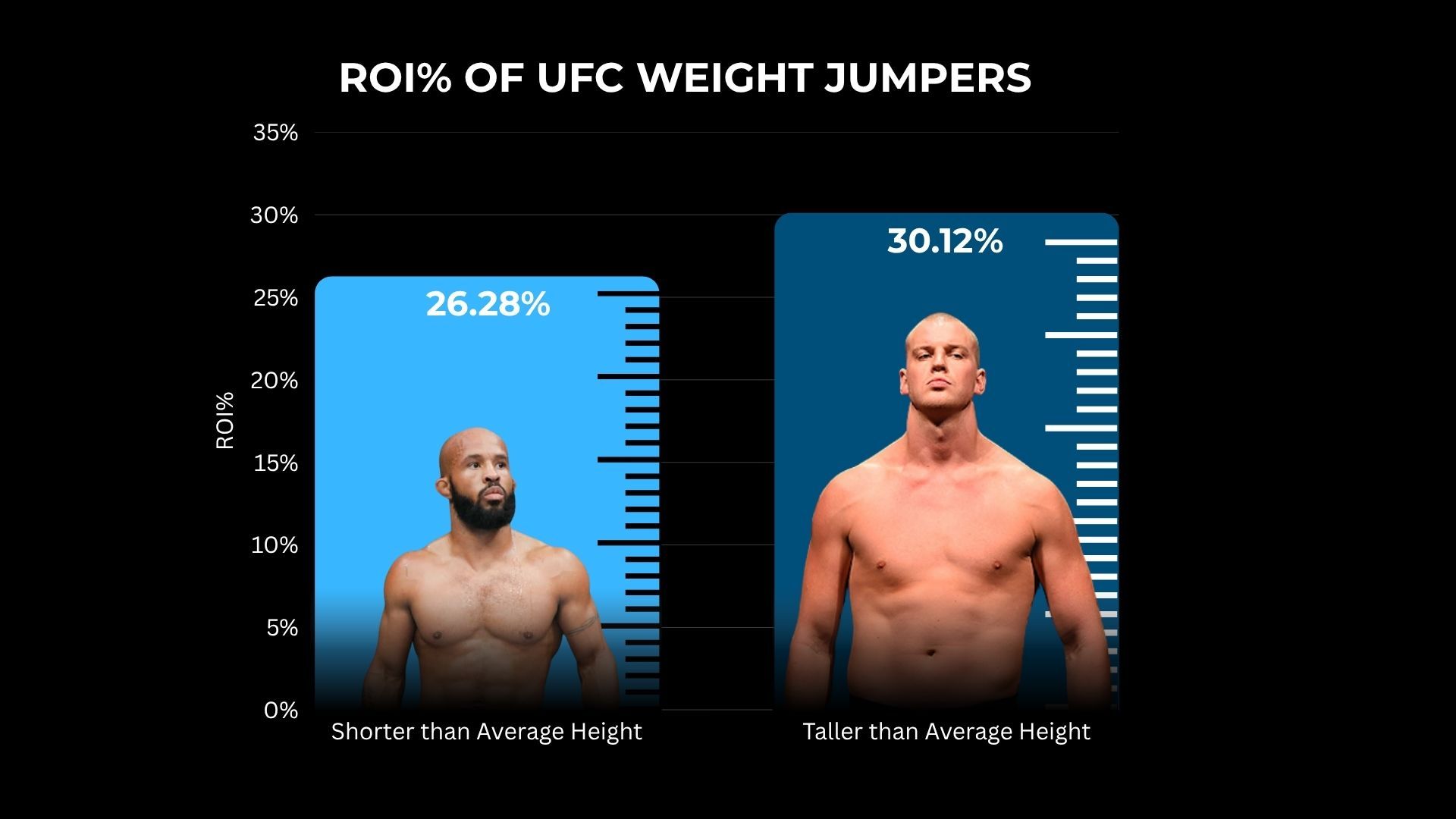

A natural question with fighters moving up in weight is whether their height can help them adjust against bigger opponents. To test this, we compared Weight-Jumpers who were taller than the average in their new weight class against those who were shorter than average.

Win Rate

Win rates were nearly identical. Taller Weight-Jumpers won at about the same rate as fighters who were shorter than average.

ROI%

The ROI% for both groups is positive, with taller than average Weight-Jumpers supporting a 30% return and shorter than average Weight-Jumpers close behind at 28%.

Takeaways

When we split Weight-Jumpers by height, taller fighters didn’t win more often than shorter ones. However, ROI% was slightly higher for the taller group, indicating a small correlation between extra height and outperforming market expectations, but nothing strong enough to make any larger conclusions.

Reach

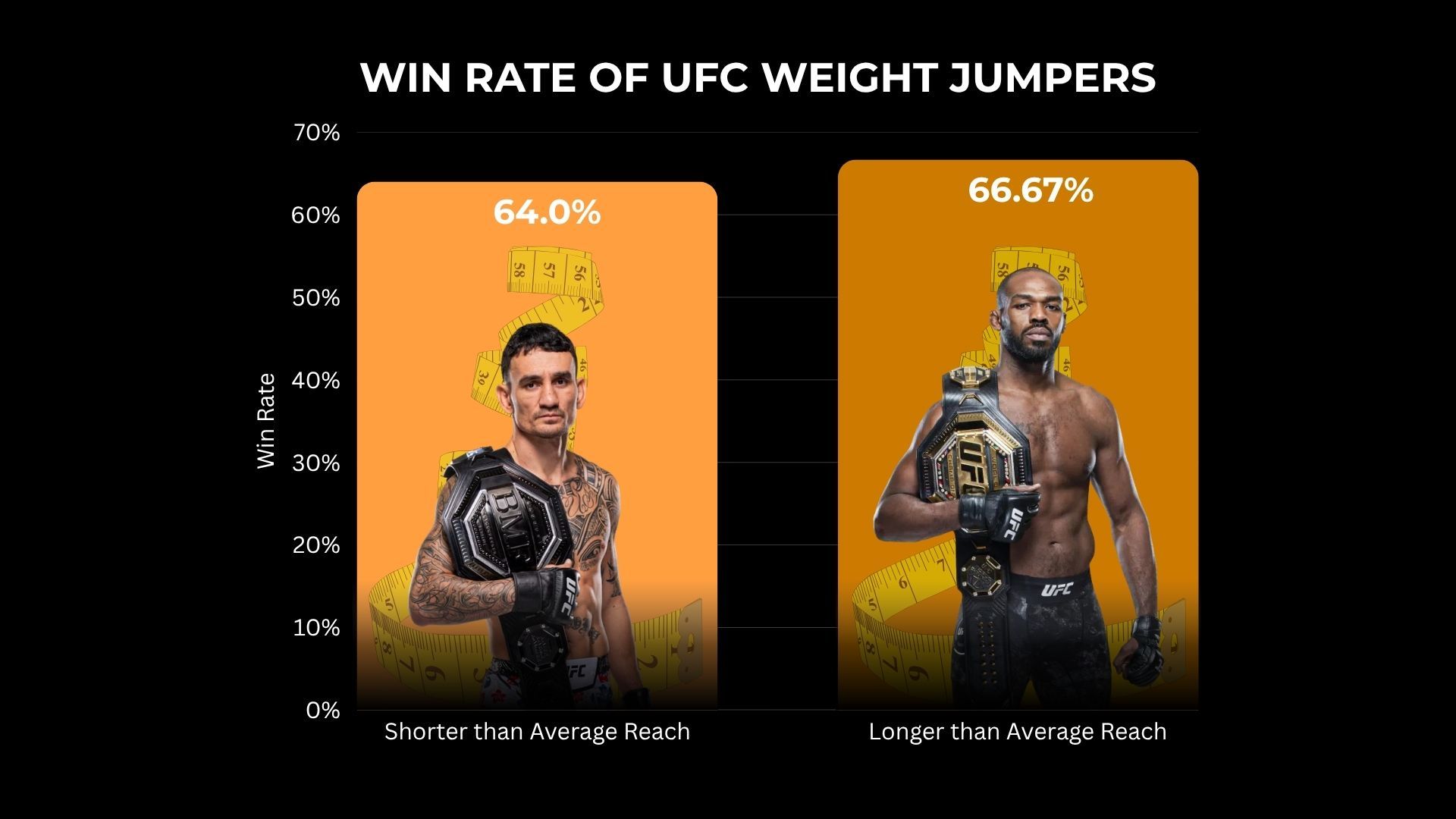

Another factor worth testing for fighters moving up is reach. Longer arms could , in theory, help Weight-Jumpers deal with bigger opponents in their new division. To explore this, we compared fighters with a longer-than-average reach for their new weight class against those with shorter than average reach.

Win Rate

Similar to height, win rates were nearly identical between the two groups, with Weight-Jumpers who had longer than average reach winning at only a slightly higher rate than those with shorter than average reach.

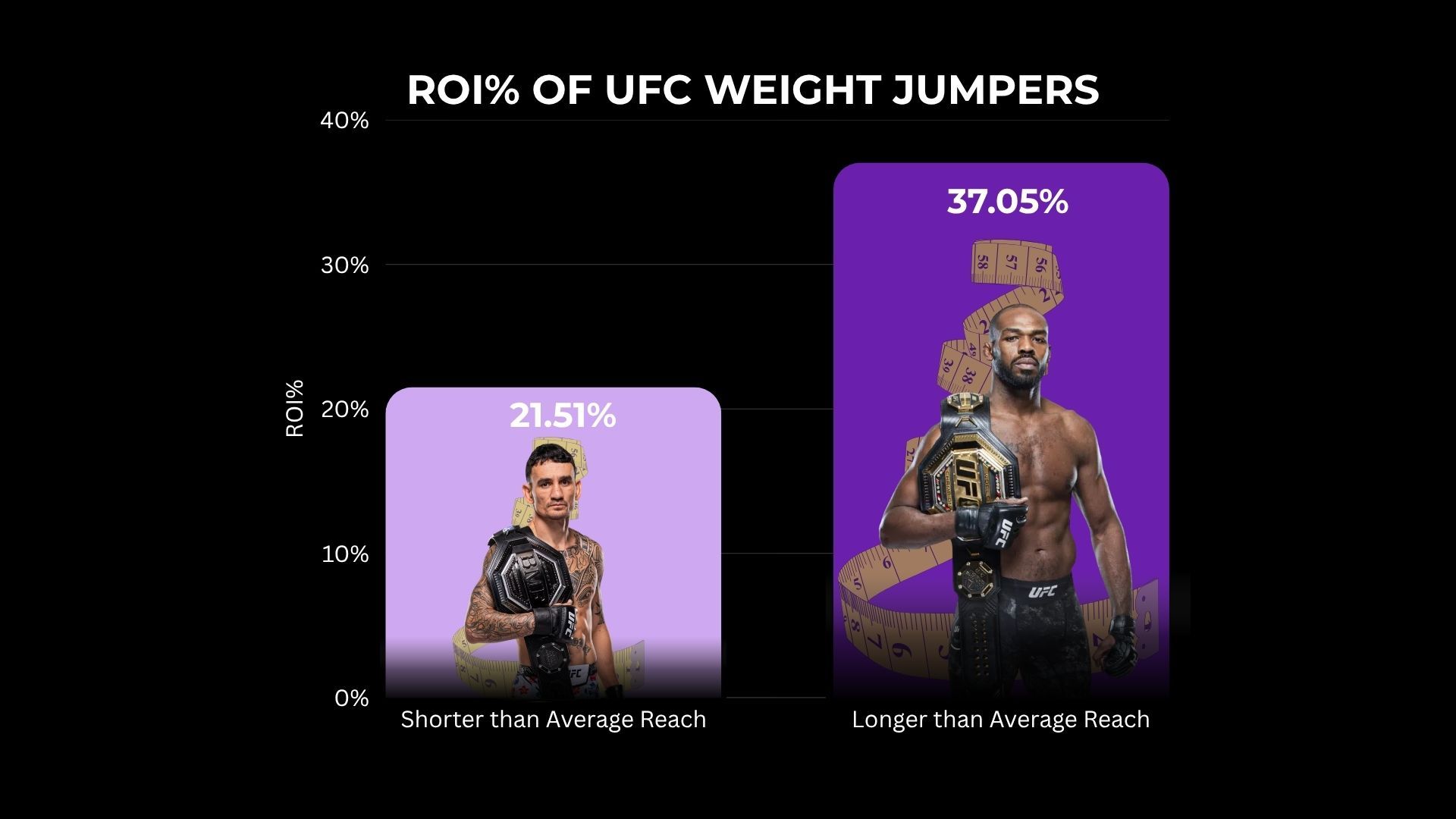

ROI%

Both reach groups returned positive ROI%, but ROI% was higher for longer-reach Weight-Jumpers at around 37%, compared to about 22% for shorter-reach fighters.

Takeaways

The reach results mirror height in terms of win rate, showing that having longer arms did not translate to more victories for Weight-Jumpers. However, the ROI% gap was much larger between the two groups in this case. Longer-reach Weight-Jumpers produced significantly higher returns, showing they have historically outperformed their market expectations more than shorter-reach Weight-Jumpers. Whether that is tied to a legitimate advantage or to the way these fighters were priced is unclear. But the difference does show that reach is correlated with stronger results against expectations.

Weight

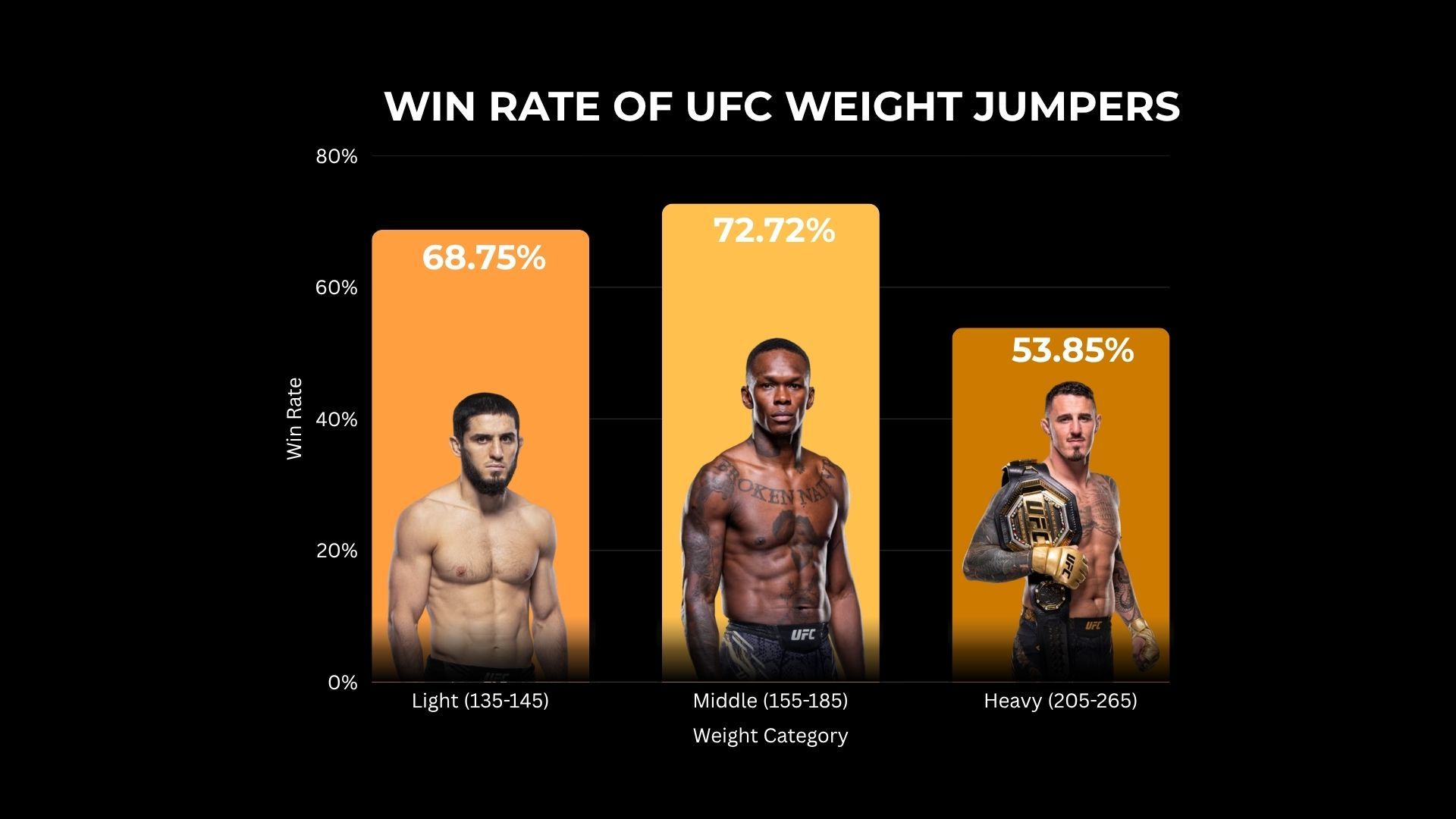

The final factor we examined was weight class. Instead of looking at each division separately, we grouped them into broader categories to spot bigger patterns. This meant putting the two lightest divisions together, the three middle divisions together, and the three heaviest divisions together:

- Light (135–145)

- Middle (155–185)

- Heavy (205–265)

Win Rate

For the first time so far, win rates showed significant variation across groups. Middle Weight-Jumpers had the highest success rate, followed closely by light Weight-Jumpers, while heavy Weight-Jumpers struggled the most.

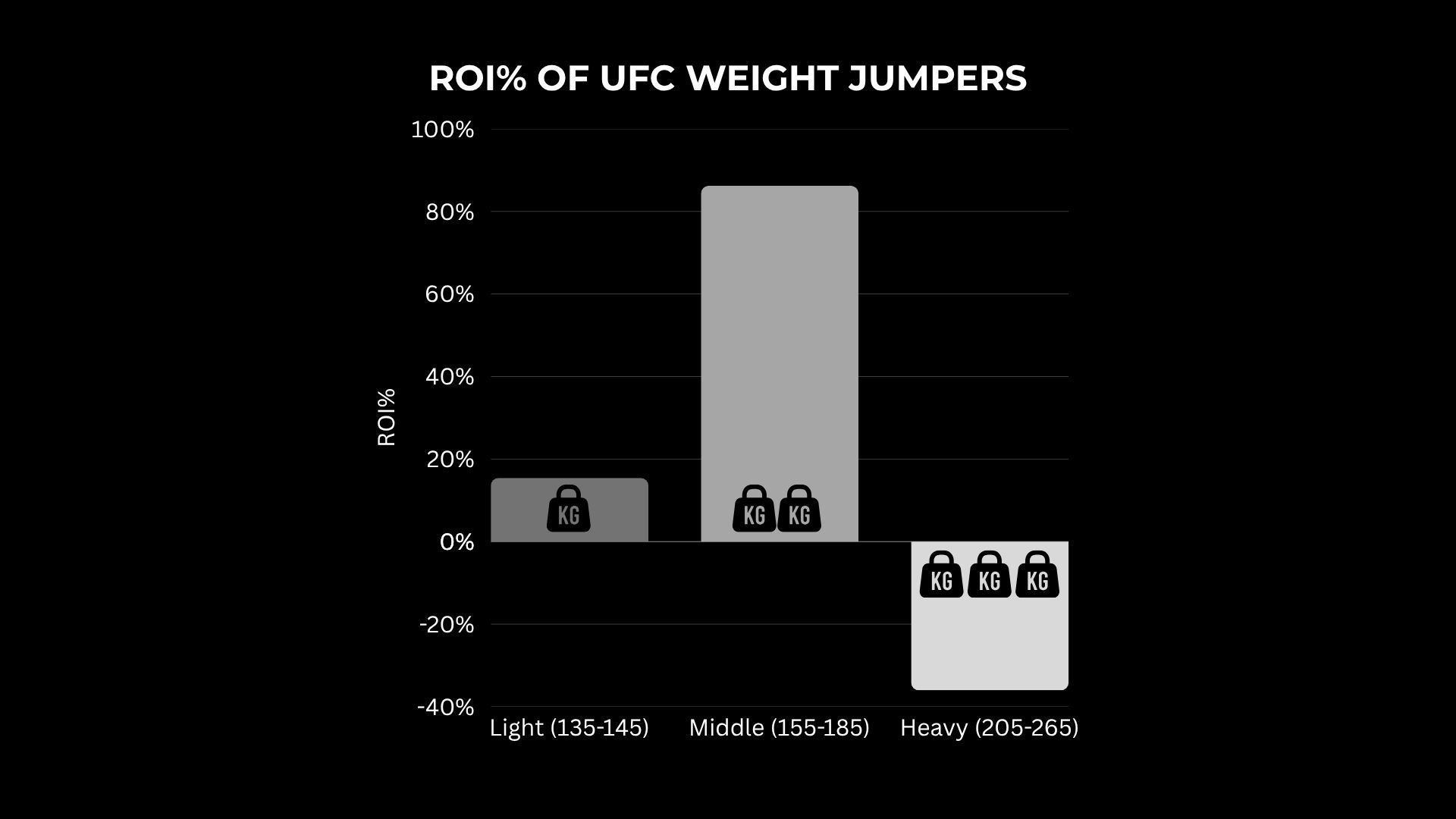

ROI%

The ROI% split by weight class showed clear differences: middle Weight-Jumpers averaged an 86% return, light Weight-Jumpers a smaller 15% gain, and heavy Weight-Jumpers ended negative at –36%.

Takeaways

Weight class showed the clearest divergence in outcomes out of the three factors we examined, making it the factor most strongly correlated with success for fighters moving up. Weight-Jumpers into the middle divisions consistently won at higher rates and performed above expectations more than any other group. Light Weight-Jumpers also held their ground with positive results, while heavy Weight-Jumpers struggled both in win rate and ROI%.

Case study: Ilia vs Charles

At UFC 317, Ilia Topuria moved up from featherweight to lightweight to face Charles Oliveira for the vacant title. With Islam Makhachev leaving the belt behind, the division was wide open, and Topuria seized the chance in spectacular fashion. Despite being shorter and having less reach than the average lightweight, he stopped the fan favorite and left as champion.

Let's look at how Topuria’s move up related to our data. In terms of size, he was below average in both height and reach for lightweights. Height showed little difference in betting returns between groups, so being shorter wasn’t a meaningful factor. Reach, on the other hand, showed a clearer split: while shorter-reach Weight-Jumpers still produced positive ROI%, the longer-reach group returned significantly higher profits. That placed Topuria in the category with historically smaller returns. Where his profile aligned most strongly with the data was in weight class. Weight-Jumpers into the middle divisions (155–185) have consistently delivered the best results, and his knockout win over Oliveira added another example to that pattern. Taken together, his win showed that even when certain size factors work against Weight-Jumpers, the advantages tied to weight class can outweigh them.

Conclusion

Our analysis shows that not all moves up in weight play out the same way. Height was not a decisive factor, while reach showed a more noticeable difference. The clearest trend, however, came from weight class. Weight-Jumpers into the middle divisions consistently delivered stronger results, light Weight-Jumpers held their own, and heavy Weight-Jumpers struggled.

The case of Ilia Topuria highlights how these patterns can apply in practice, even if no fight aligns perfectly with every trend. While the correlations we found are informative, real fights involve countless variables that numbers alone can’t capture. Overall, our data gives a solid framework for thinking about Weight-Jumpers, but the exact reasons why certain groups have over performed market expectations and analyzing whether those trends will continue are the key to further contextualizing these types of fights.